In order to keep the plan premiums from incurring a significant increase for the FY26 plan year, Highland purchased a higher deductible plan from BCBS IL, and Highland now pays for a self-funded component that covers the difference between the employee facing and BCBS IL plan.

Effective 7/1/2025, Highland is funding an HRA for employees who are enrolled in the Traditional and Co Pay medical plans.

The HRA applies to medical claims only and has been established to assist during the coinsurance period between the employee facing deductible and the true BCBS IL deductible. Highland has enlisted Flexible Benefit Service LLC (a.k.a. Flex) to administer the HRA.

Example…The Traditional medical plan has a $1,000 employee facing deductible, but the actual BCBS IL plan deductible is $5,000. The claim is processed by BCBS IL and sent electronically to Flex. Flex processes the claim through the HRA. The HRA will pay 80% of each claim between $1,001 and $5,000, and the participant is responsible for 20% of each claim. The HRA money is paid to the participant and not the medical provider. The participant will use the HRA reimbursements they receive to pay their provider.

We advise participants to keep an eye on their Flex account to ensure claims processing through BCBS of IL are processing correctly in Flex. Participants will receive an email from Flex each time a claim is processed.

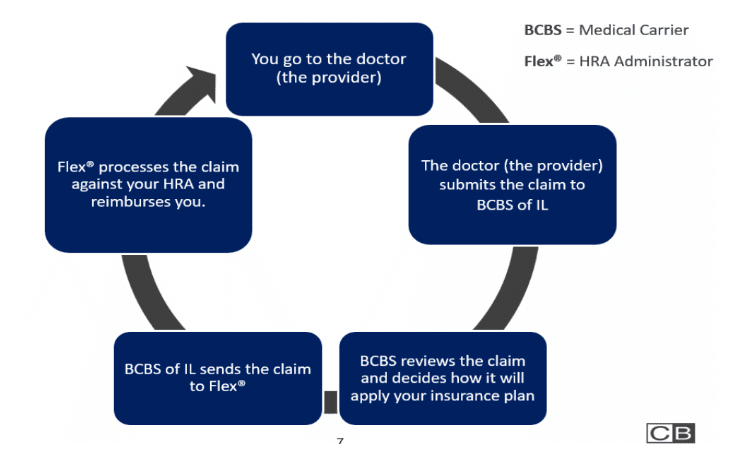

Below is a flow chart of the process between BCBS of IL and Flexible Benefit Services.

FSA (Flexible Spending Account):

Flexible Benefit Service LLC (a.k.a. Flex) is administering the FSA accounts for Highland.

There have been a couple of changes for the FY26 plan year.

- Due to the introduction of the HRA (Health Reimbursement Arrangement), FSA debit cards can only be used for Dental, Vision and Rx expenses. It is important to note that Dental and Rx claims are also electronically submitted from BCBS of IL to Flex for processing. When a claim is electronically submitted, and a participant has available funds in their FSA account, Flex may reimburse the participant which could result in an over payment. The participant may not want to use their FSA debit card for Dental and Rx expenses, at point of service, to avoid being reimbursed in error.

- If a participant has an HRA and FSA, the participant will automatically be reimbursed the 20% coinsurance during the HRA deductible period, using available FSA funds.

If a participant has any questions or concerns regarding their account balance, they may contact Flexible Benefit Service LLC via email or phone.

P: 888-345-7990

Opt 1 employee

[PNG, 30.21 KB]

[PNG, 30.21 KB]